Facebook, Meet Apple; Apple, Meet Facebook

Thursday, August 23, 2012 at 11amBy John Friedman

I’m an old dog when it comes to Facebook. I, along with a lot of 50-somethings, used it quite a bit a few years ago, mostly to connect with people from our highschool days back in the ’70s. It was great for catching up with long-lost old friends. That lasted about half a year.

After that novelty wore off, though — after lost connections had been remade (and some once remade were unmade again) — the thrill was gone.

* * *

The big roll-out in the tech news world today is FB’s release of its new app for iOS5, the operating system at the heart of Apple’s mobile products. This app is native, by which I take them to mean that the app sits on top of iOS5, rather than sitting inside of Safari sitting on top of iOS5.

On the Twitter machine people are commenting that the new app is snappy and well done, but that might be insiders’ hype (others say, I’ll believe it when I see it).

Whatever the case, the stock has not moved much. As I write this, the NAZ is down about 0.8% and AAPL shares are up about 0.5%, so figure about a 1.5% bump-up. In the grand scheme of FB price movements the last three months, that is not moving much.

[Aside: if you want to see something that *is* moving much, look at what happened to Todd Akins’s polling results in today’s Rasmussen, which shows a 13% swing to the bad for him in a few weeks’ time (Rasmussen has twitchy numbs, so this might exaggerate the reality a quite a bit).]

Given that the conventional wisdom is that FB’s most significant problem is its weakness in generating revenues from mobile platforms, and given that iOS is one of two dominants mobile platforms, you’d have to characterize the stock market’s response to today’s product roll-out — when a lot of people are feeling the new software for the first time, and when the rumor has now become a reality that, so far, sounds to be a good reality for users — as a yawn.

And then there’s that old stock market adage that says you should buy on the rumor, sell on the news.

333 words

On the Rarified Fringe of the Financial Media Trail with Blodget and EPI

Wednesday, August 22, 2012 at 11amBy John Friedman

In the great unraveling of the Internet bubble in the year 2000, the rise and fall of Henry Blodget was among the biggest, gossipy’est, schedenfreude’iest stories of all.

In 2003, under allegations of publicly touting the very same high-flying Internet stocks that he was simultaneously selling for his own account, Henry was permanently barred from the securities industry and fined $4 million.

Today he is, among other things, a talking head on Yahoo Finance and a writer and apparent principal of Business Insider (being banned from the securities industry precludes you from certain sorts of employment and certain ways of being paid — e.g. you cannot be employed/paid as a stock broker and you cannot be employed/paid as an investment adviser, etc, but you can be paid for punditry that for all intents and purposes looks and feels quite similar to what stock brokers and investment advisers do all day long when talking to customers and clients).

* * *

I bring this up because today I read a piece by Henry in Business Insider entitled HEY, AMERICA: Check Out How 90% Of Us Have Gotten Shafted Over The Past 30 Years…, the money quote of which is this:

From 1981-2008, average incomes grew by a healthy $12,000. But a shocking 96% of that growth went to the richest 10% of the country. Only 4% of it went to the other 90%

Henry based that assessment, and the entire article, for that matter, on an interactive tool at the Economic Policy Institute.

Hmmm . . . I thought to myself, Henry has waded into the deeply political, and not on the usual side the Financial Services Media Complex (the FSMC) takes, which, after all, is unusually uniformly of the lower taxes/reduced regulations/set business free ilk. See Larry Kudlow‘s blog (no permalink needed; any piece will do) for Exhibit A.

* * *

So then I went to the horse’s mouth, which in this case is the Economic Policy Institute, which notes on its About page that,

EPI was the first — and remains the premier — think tank to focus on the economic condition of low- and middle-income Americans and their families. Its encyclopedic State of Working America, published 11 times since 1988, and now for the first time in complete electronic form as well, is stocked in university libraries around the world.

Seeing that phrase about low- and middle-income Americans, I just had to do a Google search of “EPI liberal” (well, actually I did a Google search of “EPI livberal” but that handiest of all Google tweaks helped me out) and, lo’ and behold, the second item had this as a title:

How to Identify Liberal Media Bias — Media Research Center

and contained this paragraph:

According to the Economic Policy Institute (EPI), more than half of America’s new wealth went to the richest one-half of one percent of families,” explained Rather. . . . But EPI is hardly independent. It was founded by Clinton Labor Secretary Robert Reich and Jeff Faux, a former aide to Michael Dukakis.

That, as best I could tell, is EPI’s true claim to infame according to those who see it as biased: it was founded by Dems. I’d be curious to hear the argument about how EPI’s data were wrong. Now *that* would be interesting. Telling me who founded the data-publisher is an interesting fact, but it says nothing abut the validity or the reliability of the data. And if the best argument is that the database in question is housed within an entity that was founded by Dems, then my critical thinking mind says that’s not much of an argument; what else ya got?

* * *

My hats off to Henry and EPI for trying to bring information to bear on the collective economic situation within which we all find ourselves, bobbing like corks in the ocean. I’d be very interested to see someone of a different political persuasion make the opposite case. However, when I type into Google economic policy institute data is wrong I come up dry.

The fall back position, though, is alive and well. When I type into Google income inequality is, Google’s first auto-fill is, greatest in which of the following countries (according to the OECD, among developed countries, the US has the fourth greatest income inequality, with Chile, Mexico and Turkey surpassing our inequality), while the second is blank, and the third and the fourth are good and not a problem, as in income inequality is not a problem.

736 words

Apples to Apples to Ice Cream Trucks: The Current Numeric Verdict is In

Tuesday, August 21, 2012 at 10amBy John Friedman

Much has been made this week of Apple becoming the most valuable company in history (as long as you ignore inflation).

One comparo really caught me eye, though, which is this pull-quote, which had lain entombed within a New Yorker-length article in Vanity Fair until Forbes was kind enough to pull out this pull-quote and publish it in a way that got noticed in our twitchy Twittery world (of which I am now part):

One Apple product, something that didn’t exist five years ago, has higher sales than everything Microsoft has to offer. . . . In the quarter ended March 31, 2012, iPhone had sales of $22.7 billion; Microsoft Corporation, $17.4 billion.

That is a remarkable thing. If there’s one thing that Microsoft has always been it’s a revenue pump. Why, they even used to get paid for *not* selling stuff! That’s right: MSFT was so dominant in the 80s and up until Netscape came onto the scene in the mid-90s that computer vendors used to have to pay it a per-computer-out-the-door fee regardless of whether a given computer going out the door had any MSFT software on it (there’s lots of text at the end of that link: search for the word “regardless” to see the relevant portion).

Now that’s a great business model. The Mafia looks on with admiration.

* * *

So when I saw the headline for Timothy Worstall’s Forbes article, trumpeting that Apple’s iPhone Is Now Worth More than All of Microsoft, I wondered, “And what do you mean by worth, Tim,” which, fortunately for all involved, is exactly the topic Tim addresses in the article.

I won’t got into that here. Suffice to say that there are many different ways to determine worth, many of which involve judgment calls and market opinions, but one of which is about as close to objective as it can be, and that is revenues — plain ol’, pure and simple Money-In-the-Door. Anyone who has ever run a business has a deep, visceral feel for what Money-In-the-Door is all about, and how it differs, starkly and brutally, from No-Money-In-the-Door.

So revs, as we wonkies like to call them, are a great way to compare — at least as a starting point — two businesses.

* * *

As highlighted in that Vanity Fair article mentioned above, the bottom line on revs, viewed through the lens of an easy-to-glom-onto, downright Reagan-esque sort of imagery, is this: the iPhone Alone woops all of Microsoft The Whole Dern Thing. Here’s the complete pull-quote:

Today the iPhone brings in more revenue than the entirety of Microsoft.

No, really.

One Apple product, something that didn’t exist five years ago, has higher sales than everything Microsoft has to offer. More than Windows, Office, Xbox, Bing, Windows Phone, and every other product that Microsoft has created since 1975. In the quarter ended March 31, 2012, iPhone had sales of $22.7 billion; Microsoft Corporation, $17.4 billion.

Nicely said Kurt Eichenwald; nicely imaged.

Now please do note well that we’re talking quarters, here. So annual sales of iPhones are in the $90 billion range. Note also that we’re not talking anything like a close call here; annual MSFT sales are in the $70 billion range (for ease of calculation and reference, I’m simply annualizing the quarterly numbs).

I’ve said it before and I’ll no doubt say it again: given that the iPhone, alone, has bigger revs than all of Mr. Softee, one really has to marvel at what Steve Jobs hath wrought.

* * *

If you’re interested in these things, please do read Kurt Eichenwald’s article; you can also see a good interview on Charlie Rose.

Warning: this interview and the Vanity Fair article are not appropriate fair for those who have a soft spot in their hearts for Mr. Softee.

625 Words

A Long-Writer Cozies Up to 140 Characters and 500 Words

Monday, August 20, 2012 at 1pmBy John Friedman

And so it begins.

In March 2009 I grabbed @JFRQ, my first Twitter handle, and immediately posted the oh-so-neither-profound-nor-interesting tweet, “Just established myself on Twitter.”

A few months after grabbing @JFRQ (did you know that the genesis of the entire JFRQ naming milieu rests on how it was always easy to grab JFRQ on a new platform? Qs are just not used very much . . . ), some rascally apparently-namesake fellow had already grabbed @JohnFriedman, so I settled for my name with the under_score and grabbed the @John_Friedman handle

The noive. I maybe should have gone for @JohnFriedman first. But it probably didn’t matter. And, as it happened, I did not use John_Friedman until recently.

* * *

It wasn’t until Thanksgiving of 2009 that I posted a couple of things under @JFRQ, but then all went silent until March of this year when, after putting that big white hardback-book down, I, slack-jawed, felt compelled — truly compelled — to post this:

Will people reading Jobs book conclude rudeness succeeds? “Intentionally wounding towards people,” wife says, was the norm. P.342 hardback

That phrase — intentionally wounding towards people — really got my attention because, of all the people I have ever come across in my entire life, I can only think of a handful who seemed to intentionally wound. Far from it, most go out of their way to be nice, even when they are being treated badly (the slow-boil crescendo scene in the American version of The Girl with the Dragon Tatoo comes to mind, when the murdering guy says to James Bond the reporter guy, “You just walked into my house right now when I asked you to come in. Even though you knew you shouldn’t. You just couldn’t bring yourself to be rude, could you?” Or something along those lines.).

And oh that 140-character limit. The final period, with which I really, really wanted that post to conclude, did not fit! I mean, there were other sentence-enders in there; how unparallel is it to not have the sentence-ender at the end of the whole thing — the most important sentence-ender of all?

And even though I really, really wanted to say, never-blinking-Silicon-Valley types (we in the Bay Area have all seen them, yes?) rather than people, the 140 character limit breached no fudge, and so it went up as shown here.

So I swallowed my normal grammar self, and posted the tweet sans period and without the much-cooler reference to the non-blinkers who intensely, often sans humor, inhabit parts south of here.

Then the feed went silent again.

* * *

Earlier this year, once I’d decided to ditch the JFRQ name and put the emphasis of all my marketing on . . . me, little ol’ me (and, yes, all the “we” references in my writing are likely to soon start turning over and popping up as “I” references, thank you TC for that comment all these many years ago), I grabbed @J_F_Financial (@JohnFriedmanFinancial is longer than the Twitterfolk allow). And, using that handle, I started to slowly feel my way through the world of short.

After unearthing the dormant @John_Friedman, I soon decided that I could live with one underscore easier than I could with two, so I changed horses (birds?). As of July 23rd, then, you’d best think of me as an under-scored me — at least for Twitter purposes.

* * *

Clearly, not much got me a’tweetin’ in the past.

But now I get it.

Like I said the other day, the Ryan announcement two Friday nights ago showed me what it was like to see news spread over the Twitter machine. And this past weekend I saw it again when Todd Akin, Senate candidate from Missouri, used the phrase legitimate rape to mean . . . gosh only knows what.

And with the political season just about to kick into truly high gear with the conventions next week, I find that the Twitter machine is the fastest way to see what the buzz of the moment might be. Yes, it might be wrong (this morning, for instance, there are indications that both Akin will stay in the race and that he will drop out, and surely one must be wrong, yes?), but it is so much quicker than the rest of the web. And now getting my PC to wake up just seems, like, so annoying, so I am also finding my little iPod Touch to be just the ticket for climbing aboard my new fave info-stream.

* * *

At the same time, the John Friedman Financial site is now live, and, to the relief of many folks, I am swearing off long New Yorker-length pieces (or at least mostly swearing them off), with my aim being to post one 500-word-or-so piece each day, usually in the morning (West Coast time). That’s about two to three minutes of reading for most folks (as best I can tell, a long New Yorker article runs something like 7,500 to 10,000 words — 15 to 20 times longer than my goal).

I am even asking my website guy if he can put the number of words at the top of the blog entry, so you know what you’re getting yourself into when you start reading the piece.

* * *

There’s lots of stuff going on right now business- and family-wise, so I’m doing a soft roll-out of the new John Friedman Financial Blog and the new Twitter feed @John_Friedman. Look for a full launch come the fall.

In the meantime, those of you who find your way here, please do let me hear your thoughts. I’m always happy to hear positive reviews, but the ones that are the most helpful are the negatives reviews. So, please, if that’s not your natural way of being, then do try on some of your best Steve Jobs, and do come on into the house. Feel free to blink, though. It’s good for your eyes.

951 words

Does Our Favorite Uncle Have a Money-Out Issue or a Money-In Issue?

Friday, August 17, 2012 at 2pmBy John Friedman

Dave Ramsey did another Neil Cavuto simulcast this a.m. — coupling his radio show with Cavuto’s TV show on Fox News. Dave and Neil talked about how Paul Ryan understands that we, as a country, have to cut spending. When your kid wants a new puppy and you don’t have the money, Dave said, you have to tell the kid no. No puppy for you! That’s the situation our country is in now.

At the end of the show, Cavuto said, Good job, Dave, or something along those lines. To which I say, In what respect, Neil?

* * *

When working with clients who are having a hard time aligning their Money-In with their Money-Out (or, in the more common, non-JFF parlance, when working with clients who are having a hard time aligning their spending with their income, or, even more so, when working with folks who are spending more than they’re bringing home), I’ve been known to say something like this:

Your savings rate is the key to your overall financial health. It’s a number, and it’s real: your Savings Rate equals your Money-In minus your Money-Out. To get your savings rate up, then, there are only two things you can do: you can increase your Money-In and/or you can decrease your Money-Out.

Now, as it happens, doing one of those things is more fun than doing the other, in the sense that doing one of those things is always about being more powerful in your financial world, while doing the other can be, but oftentimes is not.

On their simulcast today, Dave and Neil did not talk about Money-In; they only lamented how spending in Washington is out of control.

I think I am understanding their perspective much better now than in the past, because one of the good things about listening to Dave over the past many months is that I’ve become convinced that he pretty-much-literally cannot see Money-In in this context, because in this context Money-In is usually known as taxes, and even a ratio of 10-to-1 (i.e., increasing budgetary health through 10 dollars of spending cuts for every one dollar of tax increases) is a big fat no-go. Because, you see, at this point we’ve gone so far down this road, since 1978 I’d say, that, for many folks, their More-Money-In-for Uncle Sam visual receptors have atrophied completely away, to blindness.

* * *

Uncle Sam, via the Federal Reserve Bank of St. Louis, serves up a wonderful website called FRED, which stands for Federal Reserve Economic Data. As you can guess from its name, FRED serves up a huge database of government data which most people would say are factual (I searched online for some naysayers and the closest thing I could find was a fellow from Kansas who thinks that the Fed’s money supply measures are misleading), so let’s posit that Uncle Sam can do a decent job of measuring how much money it has coming in and how much it has going out.

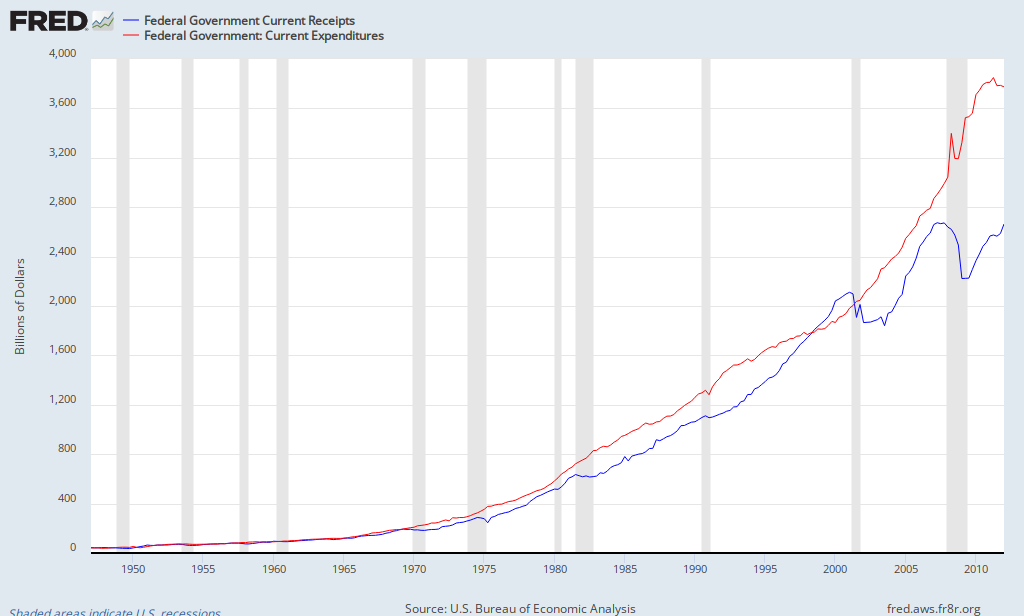

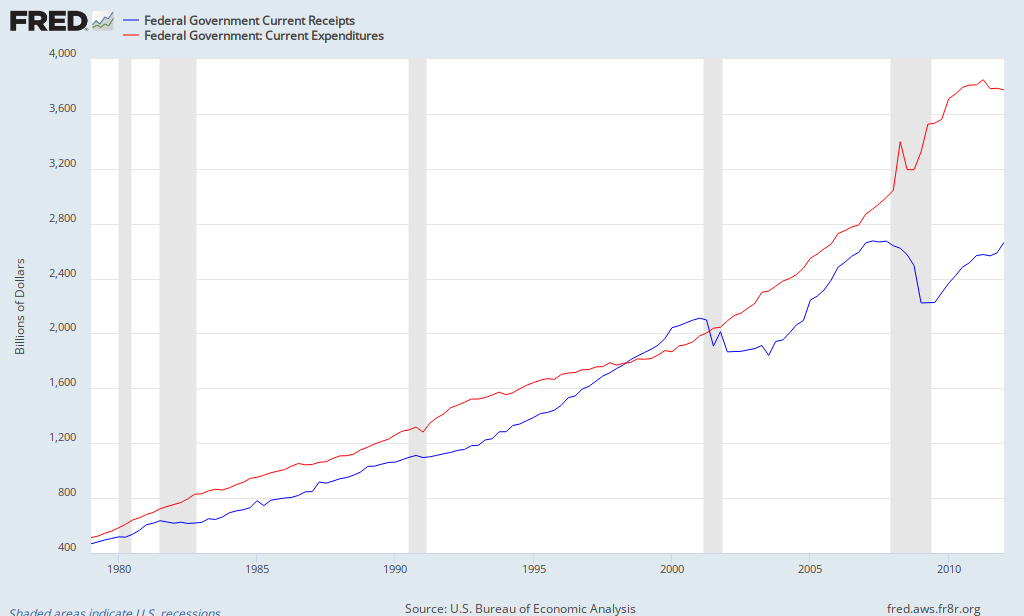

Per FRED, here is what the federal governments’s Money-In and Money-Out look like from 1947 through the most current data (I’m not including a link because I cannot figure out how to do a permalink to the actual graph) (FREDsters, am I missing it, or FREDsters, do you have a nice-to-have feature list to which you can add permalinking?):

Now let’s chunk that picture up some, so we can zoom in, using 1978 as a cut-off point, with one graph showing the maximum amount of FRED data through 1978, and the other chunk showing the maximum amount of FRED data post-1978.

Here is 1947 through 1978:

That gray vertical bar in the 70s and the jog-down of Money-In is all about the nasty recession in the early- to mid-1970s — you know, the one following the oil embargo.

And here is 1979 through the present:

So now there’s another nasty gray vertical bar and jog-down — the one we are still in, and some other stuff as well.

This is yet another Rorschach test. So what’d’ya see? Does our dear Uncle have a Money-Out problem or a Money-In problem?

Or both?

Hmmm . . .

633 words