The Week that Last Week Was: Choosin’ Your Zoomin’

Friday, August 19, 2011 at 10pmBy John Friedman

The Context: I initially published this piece as a group email in late mid-August of 2011. It was very much of-its-time, as the second week of August 2011 had been one of those high-volatility, big-fear, no-fun periods that happen in the financial markets from time to time (and, seemingly, from time to time happen more frequently than from time to time . . . ).

I happened to be on vacation that week, and therefore started writing a group email (now contained in this blog post) the following week, mid-week, when things had calmed down considerably but at a time when people were still very, very much smarting from the market roller coaster of the previous week.

This is what I wrote at that time.

This is a group email going out to friends and clients of JFRQ Consulting, setting out a thought-piece occasioned by the roller coaster ride the stock market took last week [i.e., the week beginning 8/8/11 — two weeks ago for folks receiving this email on 8/22/11; throughout this piece, references to “last week” are to the week beginning 8/8/11].

Those of you who know my work can well guess what I have to say about that roller coaster ride. In fact, as a useful exercise, please think about stopping your reading right here and writing down what you think about last week and, for good measure, what you think I think about last week, and then please do continue on to the thought-piece . . .

* * *

The Liberal Arts Perspective: Fractals Can Illuminate Your Experience as an Investor

We start metaphorically and liberal arts’y’y, by looking at a seemingly unrelated topic which, to one way of thinking (mine, anyway), is interestingly related to the tumult in the markets last week. Now some of you have heard me bring in the also-liberal-arts’y connection between quantum mechanics and investing, but that topic will wait for another time and another email; instead, here we look at fractals, and, more narrowly, at one branch of the fractals tree residing in the mathematics forest — topics all made popular by the book Chaos from the late 1980s, giving rise to all sorts of hard-to-look-at fractal t-shirts — and at how fractals can shed some light on what it is to be an investor in the late summer of 2011.

The Wonder of the Fractalized Perspective: How Far as it from Bolinas to Bodega Bay?

We begin with a simple question: how far is it between Bolinas and Bodega Bay? As it happens, the answer has a fractal’y, chaos’y streak running through it, and is not as clear cut as you might think.

As the car drives, the journey from Bolinas to Bodega Bay is 45.5 miles. That’s simple and fairly straightforward.

But if you click through to the link in the preceding paragraph, you’ll see a Google Map of the shortest route to take, and you’ll see that the hills and mountains of our lovely coast necessitate that a car take a question-mark-shaped route. So we can surmise that, as the crow flies, the shortest distance between Point B and point BB might be something less than 45.5 miles. So let’s call it ~35 miles (all you crow out there, please feel free to correct me . . . ).

Getting from B to BB the Long Ways Around: 250 Miles or More.

But how about if, rather than going as the crow flies or as the car drives, you decide to walk all the way along the coast (assuming it can be done and assuming that you can do it)? How long would it be then?

Walking the coastal route, to get from B to BB you would have to go all the way along the coast of the ever-beauteous, ever-magical, ever scene-of-the-consummation-of-my-betrothal-nearly-six-years-ago Point Reyes. Walking out onto Point Reyes would in turn mean walking around Drakes Bay and into and all the way around each of the four sub-bays that make up Drakes Estero, after which you would have to walk the entire south facing shore of Point Reyes. Once you completed that leg of your journey you would then need to head north and a bit east along the miraculously straight, beachy part of Point Reyes, past Abbotts Lagoon and still on, all of which is a pretty far stretch. And then, just as you came upon the most northern point of the Point Reyes Peninsula, and you were looking right at Dillon Beach and Bodega Bay, you would come to know, in a deep, more intimate way than you ever had before, that there is nothing at all like a bridge to take you there from here, and that you therefore instead had to walk back south and circle around Tomales Bay — in its entirety — which would at last get you off of the Point Reyes peninsula and back onto the coastline proper (so to speak), which can then take you fairly straightforwardly northwestward onto Bodega Bay (if you’re tide-timing is good and if you’re OK wading through the watershed just north of Miller Park.

My hunch (given the lack of roads on this route, Google Maps is of no help in this regard) is that, via this full-on coastal route, your walk from B to BB would be 250 miles or more (Drakes Estero, with all its inlets and bays, might add 50 miles to your journey all by itself).

So how long is the coast between Bolinas and Bodega Bay? Is it 45.5 miles (as the car drives), or is it 250 miles or more (as the person walks and weaves and wades and wobbles upon cliffs)?

And, while we’re at it, here’s another question for you: what if you were an ant making the coastline trek, going into every nook and cranny that’s bigger-than-an-ant’s-leap (assuming ants can leap) and therefore something which you, in your role as ant, must walk around?

Mightn’t you, as an ant, find the journey from Bolinas to Bodega Bay to be a journey of a thousand miles or more?

Hmmmm . . .

The Coastline Paradox: There are a Lot of Ways to View Wiggly Lines

This line of inquiry is called the Coastline Paradox. One popular ‘splainin’ of the Paradox looks at Britain’s coast, and notes that, if you use a hypothetical ruler roughly 60 miles long, and lay that ruler along each chunk of coast, the coastline would measure out at roughly 1,700 miles long, while if you use a hypothetical ruler that is only half that length (and therefore able to be laid upon smaller and therefore more numerous chunks of coastline), the coastline would measure out at more than 2,100 miles long.

Cool, huh?

And to really drive this point home, please have a look at this beautiful schematic depiction of the Coastline Paradox, called the Koch Snowflake, paying special attention to all three pictures on the right side of the page (ignoring, if you are like most people, the hieroglyphics on the left, and definitely grokking the two very groovy animations). Yes, folks, math can be amazing.

So the point is this: wiggly lines can look very wiggly if you look at them up close and personal, and much less so if you look at them from a vast remove.

Or, putting this in the parlance of Google Maps, GPS and other similar devices, zoom in and you see lots of wiggles and no straight lines; zoom out and you see fewer wiggles and more straight lines.

OK?

So now let’s bring this back to the stock market, shall we?

* * *

Looking at the Markets Via a Three-Month Perspective: Nothing Much Going on . . . and then Splat!

Let’s bring this back to the stock market by looking at the relative numbs from last week, in four-color pictorial representation over a three-month period ending last Friday, with the red line representing the pricing of the overall bond market, the green line representing the pricing of the overall U.S. stock market, and the blue line representing the pricing of the overall everything-but-the-U.S. stock market.

So let’s call this the three-month zoom-in:

So, yes, that is a major downdraft. And, yes again, that was a major roller coaster ride last week, with both the international and domestic stock markets (the blue and green lines) vacillating between 18% and 13% off from a month earlier, forming a fairly perfect W last week. And, yes yet again, during this period the bond market (the red line) did that steady-as-it-goes thing that it tends to do, until the stock market roiled, at which point the bond market did that come-all-ye-safety-seekers thing that it also does and, in doing so, actually increased in price.

And, yup, that price increase in the overall bond market last week means that the S&P downgrade of U.S. debt (hyperlink to primary info not possible via the S&P site) — which happened after market-close the Friday before the Monday marking the beginning of the W-week last week — utterly failed to convince bond buyers the world over that the U.S. was a less-worthy credit risk one day to the next, as, come the following Monday, people all over the globe urgently sought out those very same now-downgraded U.S. bonds. And, since things that are urgently sought after tend to become more pricey, all those bond seekers drove the prices of those bonds up up up. And, yes, that price increase meant that the interest rates those bonds pay went down down down . . . and if you don’t understand that whole bond prices up/interest rates down and vice versa relationship at a fundamental, conceptual level, then you don’t understand the first thing about bonds yet (I can, if you like, help you understand that first thing . . . just ask and we’ll make it so . . . ).

Looking at the Markets Via a Two-Year Perspective: A Lot of Up Going on . . . and then Splat! . . . but Not Enough Splat to Undo All of the Up

But now let’s zoom out a little bit, and view that same series over a two-year timeframe rather than a three-month timeframe. At this zoom level, the picture looks rather more rosy:

Now the numbers show a very big updraft, of between 20% and 35%, starting about a year ago, with most of it happening in the first six months of that period and a lot of it being undone last week, when a good chunk — but by no means all — of that appreciation went buh bye. That’s the W over there for the green and blue lines, all the way over on the right; due to the chart covering more time, though, the W is now all scrunched up, left-to-right.

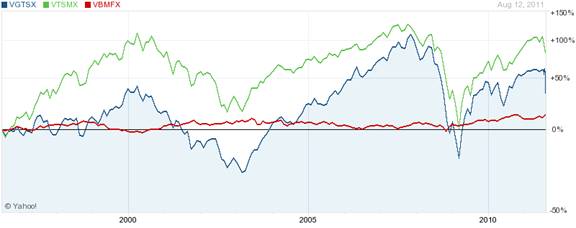

Looking at the Markets Via a Fifteen-Year Perspective: A Lot of Up and Down Going on But More Up than Down

And how about if we zoom all the way out (all the way out for this type of Yahoo graph, anyway) to 15 years? Now we see this:

That would be an up-down-up-down-up sort of ride, with the up currently winning the day by quite a bit (and with domestic stocks handily whooping international stocks performance-wise — are you surprised by that?).

More descriptively, you could call that a slow and steady up followed by a slow and steady down, and then an even slower up followed by a very, very scary and very, very quick down, and then a pretty fast up, with just a hint of the drama and tragedy of last week peaking out of the chart right at the end, as last week’s W is now squished into a line that, in the grand scheme of things, is not really all that noticeable, is it?

So when using a 15-year zoom things look pretty good, but when using a three month zoom level things look horrendous. And each zoom in between tells a different, though related, story as well.

And how far did you say it was from Bolinas to Bodega?

To Every Person, Turn, Turn, Turn, There is a Zoom Level, Turn, Turn, Turn

So that’s all well and good, but let’s bring this back to your everyday life, back to you you you, and let’s do that by asking this question:

In which zoom level do you live and breathe?

Do you live in the present? In the here and now? Or are you the type who plans ahead a lot, and thinks about yourself way out into your future? Or are you like most folks, falling somewhere in between — planning for the future but also really looking forward to this weekend? Or do you live in a world of regret about the past — about paths not taken?

To Every Money-Storer, Turn, Turn, Turn, There is a Zoom Level, Turn, Turn, Turn

And more narrowly, when viewing your stored-up money, do you view it in terms of the here and now, or out in the future? Or do you think about it in the past (a lot of folks are still would’a could’a should’a’ing their tech investment portfolios circa 2000 . . . )

Or do you view your stored-up money at the zoom level of three months? That’s the first picture above, showing all’s well but then a not-at-all-ending-well flourish last week — showing the W in vivid, stomach-churning-for-most detail

Or maybe you view your stored-up money at the zoom level of two years? That’s the second picture shown above — the steady up followed by the last couple of weeks of drama — where the W is a bit less visible.

Or maybe you view your stored-up money using a fifteen year zoom? That’s the third picture above; in that picture last week’s W is not barely noticeable.

When it comes to investing, most people’s zoom level varies between not even looking to, when things get riled up, now, right now. And that means that market meltdowns like the one we had last week loom large, while market uprisings go mostly unnoticed. So for these folks last week’s market action was gut-wrenching and resolve-allaying — and still is, and the uppermost thought in their minds vis à vis the market is, should I just go to cash and be over and done with this whole dang thang?

To Every Investment, Turn, Turn, Turn, There is a Zoom Level, Turn, Turn, Turn

Now I’m all for living in the here and now (in fact, I have been known to say, mostly inaudibly, be here now, you what-a-maroon to earphone-implanted, phone-sucking pedestrians who absent-mindedly and, I think, thoughtlessly and rudely, walk into me on the narrow sidewalk-asked-to-serve-as-pedestrian-super-highway known as Montgomery Street at rush hour).

But when it comes to investing, I think it’s good to live much more in the future or, in the parlance of this email, it’s good to use a further out zoom level — one that covers more time. And taking that a step further, I’ll add that it’s also good to use different zoom levels for different chunks of money that you have stored up, each in its own vessel, each nicely designed to fulfill a specific goal of yours.

Retirement Assets: Zoom All the Way Out, and Look to Long-Term Appreciation

For instance, when it comes to retirement accounts, a lot of people’s zoom levels are best measured in decades (that is, they are twenty or more years away from retirement). And it is in the course of decades that the stock market has typically worked out very well indeed for investors. During each of those decades there were, along the way, some scary times that made everyone fearful, but those who hung in by and large made out great, as even the best-of-times/worst-of-times fifteen-year period we just lived through can attest (note for the detail-oriented: yes, if we used a 10-year timeframe, the picture is less rosy, ending up as a whole lot of carrying-on without much result — a whole lot of ruckus and hubbub, doing nothing a’tall but taking you back to whence you came, price-wise).

The moral of the story, then, for the retirement accounts of most people in, say, their 40s or younger (50s or less for some people), is that their retirement account money should be stored away in assets that are along the lines (no pun intended) of the green and blue lines in the pictures above — the sort of big-ups/big-downs-but-generally-bigger-ups-and-smaller-downs sorts of lines that domestic and international stocks tends to draw out over time.

Or, stated in the parlance of this email: for most folks retirement assets are best stored in assets that tend to look good at a twenty year zoom, zoomed all the way out.

Your Child’s Education Assets: Zoom Further and Further In as Your Child’s Age Increases (Just Like What You Do with Retirement Assets as You Near Retirement)

And how about education savings accounts, like 529 plans? Pretty much by definition most people’s zoom level for this sort of stored-up money is less than two decades, and, as time flies by and kids grow up before you even know it, their zoom levels should decrease each year, ultimately becoming less than a year.

So let’s say that Pat and Leslie, your twins, are both off to the University of Oh-My-Gosh-It-Costs-$50k-a-Year two falls from now, in which case the $100k you need for tuition is needed, for all intents and purposes, now, right now. In this now, right now context you can’t help but think about the W of last week — of the down/up/down/up that saw as much as a 15% drop in the stock market — can you? And you can’t help but think about the scary situation for you and the twins in which, just one month ago, you had your $100k of hard-earned, sorely-stored-up money set aside for the twins’s tuition, which you planned on shipping off to the University of OMGIC$50kaY in the months ahead, but which is now, after last week, $15k short of the $100k you need. Geez, you think to yourself, we could have had so much fun with that money, rather than seeing it evaporate in a week in the stock market. And now I either have to come up with another $15k or make a Sophie’s Choice about which of the twins is going to go to University of OMGIC$35kaY.

The moral of the story here is this: if you need the money anytime soon (let’s say that the “soon” here means less than ten years, though for some people “soon” should be something less than ten years), then you typically want the money to be stored in a way in which the future looks to be more like the red lines above — the steady-as-it-goes lines — the ones drawn out by the price movements of the overall bond market.

Or, stated in the parlance of the email: for most folks, money for the kids’s education is best stored in assets that tend to look good at anywhere from a ten-year zoom (when the kids are toddlers) to a two-year zoom (when the kids are teenagers) to a three-month zoom (when the kid are already off in school, and you are scrambling to put together tuition for next year).

And, yes, if you have an auto-pilot sort of 529 Plan (which most of them are, other than those managed by American Funds), this change in zoom level is built into the product itself, i.e., when you set up the account for your kid you tell the 529 plan how old your kid is and, from then on, the 529 plan changes over your stored-up money from mostly stocks to mostly bonds, in keeping with the impending need for the money. That’s the auto-pilot.

And, yes again, this sort of auto-pilot approach, taking you from mostly stock investing to mostly bond investing, is what target date mutual funds — funds with, e.g., 2020 or 2025 in their name — do for you as your near retirement, and is also something you can do on your own if you have both a mind for such things and the stick-to-it-ive’ness to actually do it on a consistent basis (some people have the former; almost everyone utterly lacks the latter).

Rainy Day Assets: Zoom All the Way In, and Look to Short-Term Cash Needs

With The Great Recession now being nearly three years old (on the ground, if not technically, leading Paul Krugman, whose predictions have been better than most, to start calling it The Lesser Depression — see the full version of that article, subject to The New York Times paywall, here) many of us have a lot of assets they view at a zoom level of now, right now.

This makes a lot of sense in our given context because lurking within most of us right now are thoughts along the lines of, I might need this money right away, so I need to keep it in cash at the bank, where I can get my hands on it on a moment’s notice, and not have to worry that the dollars I stored in there are, at the very moment I actually need them, worth something like 85 cents.

So if for you it’s been threatening rain for three years, or if for you it’s actually raining, then your rainy day money is a very important part of your financial health. Depending on your particular weather report, then, your rainy day money very well might not be well-suited to even the red line sorts of investments set out in the pictures above, and should instead be in cash cash cash. As in at the bank. As in rainy day money should be stored in cash, as in, dollars that will always be dollars.

The reason for this lies in the red lines up above. See how they have all gone up? See how the red line is up 3% in the last three months alone, so that bond prices overall have increased that much? One of these days, that up will go down.

When interest rates go up (which Ben Bernanke said very well might not happen for until mid-2013) [August 2012 update: the timeframe is now through the end of 2014] those prices will come down (there’s that rule again about bond prices and interest rates moving in opposite directions) and when that happens the dollars you put into bond investments will end up being something like 97-cent dollars of maybe even 90-cent dollars. Ouch. That would undo a lot of the good that can come from owning bonds.

So the moral of the story here is a bit more complicated: your rainy day money should be in cash or, if you can stomach some possibility of having a portion — greater or smaller depending on your particular situation — of your rainy-day-dollars becoming, say, rainy-day-three-quarters-and-a-dime-and-a-nickel, well, then maybe, just maybe, a part of your inclement weather protection should be in bonds.

Big Picture Summary: Know Your Zoom and Set Your Expectations Accordingly, and Do Think About Having Assets that Complement Each Other

So, big picture, what does this mean? It means that, if last week’s stock market gyrations had you totally freaked out (for lack of a better term) about your financial health, then you probably have unrealistic expectations about what sort of a journey you agreed to take when you invested your money. If you invested via the green or blue lines above (i.e., into domestic and international stock investments), then you should not be surprised when the market downdrafts — especially after we saw a much worse downdraft in late 2008/early 2009. In fact, you should probably be a bit happy, because the downdraft means you can buy more of what you want at a better price, which in your decades-long time frame — your twenty-plus year zoom — is apt to serve you well.

And if you went for the red sorts of lines (bond investments), then you were able to watch the carnage of last week from the sidelines. The question for you now is whether it is time to start buying some more stocks given that bonds have had a very incredible, very long-lasting appreciation (interest rates have been going down foe years and years and tears . . . ) that one of these days — we know not when — is going to go away.

And if you’re like a lot of folks and own some of both, then, please, appreciate each for what it is. Together they can create some magic which, on their own, they cannot. So please appreciate your bonds for their steadfastness and for the nice flow of income they provide to you (income flow which we have largely ignored in this email and which every picture in this email totally ignores) but also understand their shortcoming of providing little or no likelihood of increasing in value (while also marveling at their symmetrical longsuit of providing relatively little likelihood of a devastating decrease in value). And appreciate your stocks for providing a good likelihood of long-term appreciation, though with only modest income flows along the way, and with absolutely no hope of steadfastness at any zoom level at all, let alone a week when a W appears. And then keep your fingers crossed that long-term stock investing history mostly repeats itself, amen.

Wrap-Up: Pay Little or No Attention to those Money-Storing Assets Behind the Curtain, Except, Say, Quarterly or Annually

So how far is it from Bolinas to Bodega? Most people drive, and it is 45.5 miles.

And how closely should you look at your stock and bond investments? You probably cannot help but pay some attention to big moves like we are currently experiencing (yesterday, after a fairly calm first three days of the week, the market was down big again, and, to end the week, today the markets opened with a mini-W (more of a small V actually), all of which has subsided so that, as I write, the stock market has settled in at about a half of a percent down), but most people are well-advised to really cozy up to the ups and get on down with the downs of their investments no more frequently than on a quarterly basis, and to also have an annual check-in, either with yourself or with a trusted helper, aided by some long-ago-written-down promises to yourself about what sort of investor you want to be (known as an Investment Policy Statement), during which you think through whether you have the proper zoom level dialed in for the assets in your particular grouping of money-storing vessels — stocks for the long-term (decades) and bonds and cash for the medium- and short-term (years and months).

And how much should you have invested in stocks and bonds vs. invested in other money-storing assets? That is a question for a day other than today . . .

4,432 words