- POPULAR POSTS

-

- Living Trusts are All About Avoiding Men in Black Robes

- Shame Shame Shame on the Estate Planning Industries -- and Me Possibly Lending a Helping Hand

- Couples and Financial Planning: Of Communication Flows and Gender-Neutrality

- A Better Solution to Hourly Billing Practices: Radical Real-Time Hourly Fee Billing

- Towards an Industry of Pure Financial Advice

- Not all debt is bad debt

- Death and Dying, and Two Tears

- Using the California Statutory Will

- When You Get Financial Advice for Free, are You the Product?

- Tommy Lee Jones, Ameriprise and the Double-Deal

- PAST POSTS

-

- March 2020

- June 2019

- January 2017

- July 2015

- February 2015

- January 2015

- December 2014

- September 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- February 2012

- October 2011

- August 2011

- October 2010

- July 2010

- June 2010

- January 2010

- June 2009

- January 2009

- January 2008

- January 2007

- September 2006

- May 2006

- February 2006

- January 2006

- November 2004

- CATEGORIES

-

- The Big Picture (44)

- The Financial Services Industrial Complex (43)

- The Financial World Out There (38)

- Investing (35)

- Politics (27)

- Being Smart (23)

- Fun with Numbers (22)

- The Big Us (20)

- Elder Years (17)

- The Ways of the World (13)

- Non-Numeric Financial Health (13)

- The Wonder of It All (12)

- Retirement Planning (11)

- Taxes (11)

- Business (11)

- Financial Jargon/Financial Language (11)

- Being Human (11)

- Financial Planning (10)

- The Financial Self Within Us (10)

- Retirement Accounts (10)

- Overall Financial Health (10)

- Insurance (10)

- The Medical Services Industrial Complex (10)

- Uncategorized (9)

- Balance Sheet Design (9)

- Spending (8)

- Debt (8)

- Friedman's Law of the First Thing (8)

- Numeric Financial Health (8)

- Top 10 List (7)

- Savings (7)

- Financial Advisors (7)

- Mortgages (6)

- Estate Planning (6)

- JFF Self-Reflection (6)

- Pure Financial Advice (6)

- What's Important About Money (5)

- Real Estate (5)

- Privacy (5)

- Building Your Financial Brain Trust (4)

- JF Self-Reflection (3)

- Online Safety (3)

- Technology (3)

- Making a Living (3)

- Scale Tales (3)

- Working for a Living (3)

- Lifestyle Decision-Making (3)

- MBAisms (3)

- Education Accounts (3)

- Money-Stored (2)

- Fun (2)

- Your Financial Personality (2)

- Financial Writing (2)

- Cashflowing (2)

- Money-In/Money-Out (2)

- Interest Rates (1)

- The Insurance Services Industrial Complex (1)

- The Legal Services Industrial Complex (1)

- Healthcare (1)

- Business of Financial Planning (1)

- Heathcare (1)

- Financial Ops (1)

- Friedman's Law of the 1st Thing (1)

- Children (1)

- Time Off from Blogging (1)

- Financial Wonkery (1)

- Couples (1)

- TAGS

-

- AUM fees (13)

- Microsoft (10)

- Dave Ramsey (10)

- Apple (9)

- Facebook (9)

- Rorschach Test (9)

- Paul Krugman (9)

- NFs (9)

- Normal Folks (9)

- George W. Bush (8)

- Mitt Romney (8)

- FSIC (7)

- WAITT (7)

- MSFT (6)

- FRED (6)

- Google (6)

- E*Trade (5)

- Excel (5)

- luck (5)

- iPhone (5)

- Ronald Reagan (5)

- IPO (5)

- Twitter (5)

- Medicare (5)

- YOYO (5)

- SFCA (5)

- Wall Street (5)

- The Fiscal Cliff (5)

- Vanguard (5)

- Ess Eff Sea Eh (5)

- Social Security (5)

- BofA (5)

- Wells (5)

- Citi (5)

- Chase (5)

- Paul McCartney (5)

- vig (5)

- death (4)

- Steve Jobs (4)

- AAPL (4)

- SCOTUS (4)

- macroeconomics (4)

- Schwab (4)

- GDP (4)

- eBay (4)

- Alan Greenspan (4)

- family (4)

- ObamaCare (4)

- George Harrison (4)

- Bill Clinton (4)

- Barack Obama (4)

- life insurance (4)

- index funds (4)

- 401k plans (4)

- John Lennon (3)

- money-in (3)

- GE (3)

- Komen (3)

- phishing (3)

- money-out (3)

- predictions (3)

- Osama bin Laden (3)

- The New Yorker (3)

- basis points (3)

- SEC (3)

- FB (3)

- Dems (3)

- Repubs (3)

- Paul Ryan (3)

- Yahoo Finance (3)

- Lehman (3)

- Groupon (3)

- mutual funds (3)

- Nate Silver (3)

- Noe Valley (3)

- Zynga (3)

- EOB (3)

- The Beatles (3)

- dentists (3)

- Medicaid (3)

- FSPs (3)

- FWoJT (3)

- Kafkaesque (3)

- commissions (3)

- TANSTAAFL (3)

- Warren Zevon (3)

- California (3)

- lawyers (3)

- Michael Kitces (3)

- BPs (3)

- Fandango (2)

- investing (2)

- BP (2)

- hockey players (2)

- General Electric (2)

- big numbers (2)

- righteous death (2)

- entropy (2)

- HP12C (2)

- PMT (2)

- savings rate (2)

- credit cards (2)

- dementors (2)

- Harry Potter (2)

- inflation (2)

- Krugman (2)

- lefties (2)

- righties (2)

- Ritholtz (2)

- The Big Us (2)

- VTI (2)

- scam (2)

- money-stored (2)

- NINY (2)

- gold (2)

- guns (2)

- writing long (2)

- bankruptcy (2)

- nuance (2)

- Proctor & Gamble (2)

- Interest rates (2)

- financial-speak (2)

- COBRA (2)

- Barry Ritholtz (2)

- The Red Queen (2)

- Vice Versa Rule (2)

- Al Pacino (2)

- PPACA (2)

- Netflix (2)

- James Bond (2)

- Mr. Softee (2)

- Todd Akin (2)

- austerity (2)

- AIG (2)

- Bank of America (2)

- Powers that Be (2)

- Game Theory (2)

- Blackberry (2)

- Bain Capital (2)

- Bad Astronomy (2)

- LinkedIn (2)

- New York Times (2)

- Mia Bella (2)

- Eric Idle (2)

- Iraq (2)

- urban infill (2)

- Market Street (2)

- income tax (2)

- dividends (2)

- capital gains (2)

- science (2)

- math (2)

- Ess Eff CA (2)

- HIPAA (2)

- Ironic (2)

- Sgt. Peppers (2)

- money managers (2)

- auto-ding (2)

- IAPD (2)

- George Lakoff (2)

- Frank Lutz (2)

- Dan Hicks (2)

- POTS (2)

- voting (2)

- Bush v. Gore (2)

- Procol Harum (2)

- Grover Norquist (2)

- Cass Sunstein (2)

- The Left (2)

- UHNWs (2)

- HNWs (2)

- Ameriprise (2)

- Fidelity (2)

- Michael Pollan (2)

- human nature (2)

- Talking Heads (2)

- MoneyChimp (2)

- eyeballability (2)

- eyeballable (2)

- Phil Plait (2)

- asset-gathering (2)

- active investing (2)

- Abraham Lincoln (2)

- fun (2)

- FPers (2)

- Meg Whitman (2)

- James Baker III (2)

- Bette Midler (2)

- Chicago (2)

- BLBHBs (2)

- Roth accounts (2)

- CAGR (2)

- IRS (2)

- PITB (2)

- simplicity (2)

- TDAs (2)

- TPAs (2)

- IRAs (2)

- 403b plans (2)

- HSAs (2)

- Ringo Starr (2)

- Johnny Cash (2)

- CPAs (2)

- Congress (2)

- free lunch (2)

- Baby Boomers (2)

- Clint Eastwood (2)

- monthly nut (2)

- oh the humanity (2)

- Monty Python (2)

- Federal Reserve (2)

- George Costanza (2)

- Top 10 List (2)

- who gets what (2)

- David Letterman (2)

- Malcolm Gladwell (2)

- Star Trek (2)

- yay (2)

- Goldilocksian (2)

- doctors (2)

- Dire Straits (2)

- Seinfeld (2)

- Soup Nazi (2)

- Quicken (2)

- pricing (2)

- Ess Eff Sea Ay (2)

- estate planning (2)

- estate tax (2)

- revenue models (2)

- Mosaic 1.0 (2)

- Internet Bubble (2)

- standard of care (2)

- respite (2)

- hospice (2)

- love (2)

- San Francisco (2)

- leverage (2)

- Mid-Market (2)

- Rule of 72 (2)

- Silicon Valley (2)

- InsCo (2)

- rules of thumb (2)

- DOL (2)

- exceptionalism (2)

- ISIC (2)

- MSIC (2)

- AARP (2)

- cause of death (2)

- dying (2)

- Howard Baker (1)

- maximization (1)

- honesty (1)

- got’ch’ya (1)

- RVW’ed money (1)

- RVW (1)

- Rip Van Winkle (1)

- banks (1)

- asset gatherers (1)

- index investing (1)

- Hindenburg (1)

- homebuyers (1)

- fish (1)

- domain (1)

- 529 accounts (1)

- TUFFF (1)

- portfolio (1)

- investments (1)

- Heisenberg (1)

- Einstein (1)

- Marx (1)

- lefty (1)

- dialectic (1)

- 9/11 (1)

- blogging (1)

- sinkhole (1)

- LIBOR (1)

- quadrillion (1)

- Aaron Sorkin (1)

- Central Casting (1)

- Olympics (1)

- Malcom Gladwell (1)

- rent vs. own (1)

- charity (1)

- giving (1)

- the cut-off (1)

- mortgage brokers (1)

- mortgages (1)

- NPV (1)

- PV (1)

- security (1)

- craigslist (1)

- unemployed (1)

- underemployed (1)

- Bill Janklow (1)

- devil numbers (1)

- South Dakota (1)

- usury (1)

- Walter Wriston (1)

- ZTABS (1)

- aggregate demand (1)

- empathy (1)

- Kedrosky (1)

- unemployment (1)

- fungible (1)

- magical dollars (1)

- simplification (1)

- scammers (1)

- vigilance (1)

- Webloyalty (1)

- fee income (1)

- George Bailey (1)

- spread income (1)

- probabilities (1)

- probabilty cloud (1)

- portfolio design (1)

- SFO (1)

- NFP (1)

- righty (1)

- wordcount (1)

- General Motors (1)

- GM (1)

- growth stocks (1)

- value stocks (1)

- Goldman (1)

- Louis Rukeyser (1)

- forecasts (1)

- survivalism (1)

- loyalty (1)

- Donald Trump (1)

- alignment (1)

- transparency (1)

- United Airlines (1)

- LUV (1)

- UAL (1)

- Kafka (1)

- Catch-22 (1)

- Suze Orman (1)

- student loans (1)

- credit card debt (1)

- multi-tasking (1)

- entrepreneurs (1)

- P&G (1)

- NPR (1)

- architecture (1)

- al Qaeda (1)

- annuities (1)

- fiduciaries (1)

- TravelZoo (1)

- portability (1)

- POPS (1)

- RQ (1)

- Inside Baseball (1)

- FINRA (1)

- SRO (1)

- opthomology (1)

- optometry (1)

- brokerages (1)

- Alfred Kahn (1)

- SkyNet (1)

- mock-up-able (1)

- un-mock-up-able (1)

- wisdom (1)

- physical health (1)

- aging (1)

- life's journey (1)

- Kinight Capital (1)

- big things (1)

- Zuckerberg (1)

- fail (1)

- BLS (1)

- Meteor Blades (1)

- job creation (1)

- U3 (1)

- politics (1)

- QnDGA Series (1)

- cashflow pump (1)

- Ezra Klein (1)

- Sarah Kliff (1)

- $716 Billion (1)

- 60 Minutes (1)

- WonkBlog (1)

- CBO (1)

- ACA (1)

- Nancy Brinker (1)

- New Coke (1)

- Tylenol (1)

- Tiger Woods (1)

- pink ribbons (1)

- CharityWatch (1)

- eleemosynary (1)

- I See You (1)

- Na'vi (1)

- Avatar (1)

- Pandora (1)

- Mr. Peabody (1)

- Wayback Machine (1)

- MUNI (1)

- John Schnatter (1)

- healthcare (1)

- EssEffSeeEh (1)

- Neil Cavuto (1)

- 10-to-1 (1)

- tautology (1)

- The JFF Blog (1)

- iPod (1)

- Forbes (1)

- Kurt Eichenwald (1)

- Vanity Fair (1)

- Charlie Rose (1)

- revenues (1)

- revs (1)

- Timothy Worstall (1)

- Netscape (1)

- mafia (1)

- Henry Blodget (1)

- EPI (1)

- OECD (1)

- Lawrence Kudlow (1)

- FSMC (1)

- Chile (1)

- Mexico (1)

- Turkey (1)

- U.S.A. (1)

- iOS (1)

- Ramussen (1)

- the NAZ (1)

- Grace SLick (1)

- Matt Ridley (1)

- Texas Hold 'Em (1)

- JFRQ Consulting (1)

- spoonerism (1)

- Archie Bunker (1)

- IPS (1)

- fractals (1)

- chaos theory (1)

- Bolinas (1)

- Bodega (1)

- Drake''e Estero (1)

- Point Reyes (1)

- Abbots Lagoon (1)

- Drakes Bay (1)

- Google maps (1)

- S&P downgrade (1)

- zoom level (1)

- Recession (1)

- JFRQ group email (1)

- US Airways (1)

- Firefox (1)

- Merrill (1)

- Reserve Fund (1)

- repos (1)

- commercial paper (1)

- Fannie Mae (1)

- Freddie Mac (1)

- P2B (1)

- Annie Lowrey (1)

- OWS (1)

- The 99% (1)

- The 1% (1)

- The 47% (1)

- % (1)

- Peggy Noonan (1)

- Jack Welch (1)

- repeat play (1)

- single play (1)

- financiers (1)

- business people (1)

- hover function (1)

- iWhatever (1)

- iPad (1)

- iTouch (1)

- Thunderbird (1)

- Mail (1)

- I Want My HDTV (1)

- HDTV (1)

- I Want My MTV (1)

- collectivism (1)

- Bad Astronoer (1)

- Phill Plait (1)

- Mars (1)

- the Moon (1)

- Bas Lansdorp (1)

- Alice Kramden (1)

- scarcity (1)

- Stop It! (1)

- ROI (1)

- Elon Musk (1)

- market cap (1)

- Intel (1)

- Trulia (1)

- LNKD (1)

- ETFs (1)

- RAND (1)

- Ralph Fielding (1)

- Votamatic (1)

- Intrade (1)

- Ireland (1)

- Billy Bean (1)

- Grinnell College (1)

- Psych 101 (1)

- Wile E. Coyote (1)

- Dick Cheney (1)

- Liz Cheney (1)

- Ron Suskind (1)

- prism glasses (1)

- happiness (1)

- Daniel Gilbert (1)

- David Cameron (1)

- Iraq are (1)

- Jax (1)

- Peg Bundy (1)

- Sons of Anarchy (1)

- SOA (1)

- Midwest trees (1)

- SFMOMA (1)

- Bay Bridge (1)

- Genentch (1)

- Dumbarton Bridge (1)

- PayPal (1)

- Loma Prieta (1)

- Nat King Cole (1)

- Impact Investing (1)

- II (1)

- Ida James (1)

- SRI (1)

- Kiva (1)

- micro-lending (1)

- Big Philanth (1)

- nineteen for me (1)

- Taxman (1)

- Tax Foundation (1)

- interest (1)

- Wesley Snipes (1)

- John Branca (1)

- Esalen Institute (1)

- Pacific Grove CA (1)

- Carmel CA (1)

- fun-ster (1)

- The Tenderloin (1)

- Lovers Point (1)

- Lighthouse Ave. (1)

- Big Sur (1)

- Tom Rush (1)

- Driving Wheel (1)

- Paul Broun (1)

- Burj Khalifa (1)

- Burj Dubai (1)

- speed of light (1)

- biology (1)

- chemistry (1)

- Donna Summer (1)

- On the Radio (1)

- mortgage (1)

- refi (1)

- wash (1)

- escrow (1)

- title insurance (1)

- bragging rights (1)

- big-fish stories (1)

- escrow fees (1)

- tax expenditures (1)

- mortgage broker (1)

- eyeballing (1)

- CNA (1)

- federal deficit (1)

- negative numbers (1)

- fractions (1)

- exponents (1)

- Murgatroyd (1)

- GOOG (1)

- HFT (1)

- 10K (1)

- 10Q (1)

- doing the zeros (1)

- Black Friday (1)

- Flash Crash (1)

- MMs (1)

- Brochure (1)

- The Item Fives (1)

- infaation (1)

- Into the Wild (1)

- x-bike (1)

- PnP (1)

- EssEff CA (1)

- stock brokers (1)

- Fox Business (1)

- Republicans (1)

- Democrats (1)

- Jim Carville (1)

- GHW Bush (1)

- Larry Doyle (1)

- Matt Egan (1)

- voting lines (1)

- NSPOTS (1)

- NSPOTSWIT! (1)

- Three 9s (1)

- embarrassment (1)

- iTubes (1)

- Ted Stevens (1)

- tubes (1)

- mobile phones (1)

- big machines (1)

- sunflower (1)

- Fibonacci (1)

- Christine Romer (1)

- tax rates (1)

- NBush v. Gore (1)

- John Kerry (1)

- Wile'y Coyote (1)

- Roadrunner (1)

- 1031 exchanges (1)

- bonds (1)

- tax-ugly (1)

- tax-beautiful (1)

- tax-deferred (1)

- Treasurys (1)

- sausage-making (1)

- CGs (1)

- ASAP (1)

- Halloween (1)

- Thanksgiving (1)

- 1040-tweaking (1)

- Gary Brooker (1)

- Proposition 13 (1)

- defense spending (1)

- nudges (1)

- Richard Thaler (1)

- The Right (1)

- The New Deal (1)

- Mother Jones (1)

- The Aughts (1)

- The Teens (1)

- Naughty Aughties (1)

- Proposition 30 (1)

- Robert Reich (1)

- the s-c s-c FC (1)

- generic advice (1)

- Uranium 235 (1)

- Uranium 238 (1)

- Tommy Lee Jones (1)

- Batman (1)

- High Net Worth (1)

- Steven Segal (1)

- Kate Blanchett (1)

- Missing (1)

- fiduciary duties (1)

- fiduciary (1)

- double-dealing (1)

- Under Siege (1)

- UHS (1)

- crevice (1)

- crevasse (1)

- Hostess (1)

- Twinkies (1)

- Hostess Cupcakes (1)

- Motorola (1)

- Jim Collins (1)

- Built to Last (1)

- RIM (1)

- dodo bird (1)

- Nutraceutical (1)

- Real Foods (1)

- David Byrne (1)

- Ding Dongs (1)

- Ho Hos (1)

- Pisces Fish (1)

- microeconomics (1)

- the GPs that B (1)

- Macro 101 (1)

- Micro 101 (1)

- wheat (1)

- chaff (1)

- liberal (1)

- Krugman on Feist (1)

- Why Y? (1)

- The Ps that B (1)

- Bill Gross (1)

- John Paulson (1)

- Allen West (1)

- Pink (1)

- No Doubt (1)

- Justin Bieber (1)

- Marco Rubio (1)

- Psy (1)

- sleeping well (1)

- Jen Wasson (1)

- Otis (1)

- financial coach (1)

- Example 7 (1)

- Wasson Design (1)

- FHA (1)

- pure advice (1)

- music (1)

- Ess Eff See A (1)

- Sula (1)

- my folks (1)

- vibrating air (1)

- gravity (1)

- geology (1)

- AMAs (1)

- MTBs (1)

- Rocket Science (1)

- BaTPC (1)

- Lincoln (1)

- M-M-MM (1)

- dentist jokes (1)

- feoffing (1)

- washing your car (1)

- slack-cutting (1)

- forgiveness (1)

- thankfulness (1)

- Michael Parks (1)

- human beings (1)

- it's a cinch (1)

- HPQ (1)

- DELL (1)

- HP (1)

- Hewlett Packard (1)

- Michael Dell (1)

- hockey stick (1)

- Autonomy (1)

- Compaq (1)

- skill (1)

- luck vs. skill (1)

- Sam Alito (1)

- Al Gore (1)

- Andy Card (1)

- Desert Rose (1)

- Bob Edwards (1)

- architects (1)

- Mohamed Atta (1)

- Taliban (1)

- Tora Bora (1)

- Afghanistan (1)

- Waziristan (1)

- Middle East (1)

- Lebanon (1)

- Iran (1)

- Hezbollah (1)

- WTC (1)

- cram-down (1)

- Stanley Kubrick (1)

- war (1)

- Bob Costas (1)

- gun control (1)

- Ted Nugent (1)

- Jovan Belcher (1)

- RCP (1)

- suicide barrier (1)

- Beach Boys (1)

- summer fun (1)

- chicken jokes (1)

- Jason Whitlock (1)

- Kansas City (1)

- Dog-Eat-Dog (1)

- life's last (1)

- Top Dog (1)

- easily deadly (1)

- YOYODED (1)

- Laura Clawson (1)

- Daily Kos (1)

- Rod Stewart (1)

- B2B (1)

- capital vs labor (1)

- labor vs capital (1)

- pix (1)

- Robert Brusca (1)

- CNN (1)

- CNNMoney (1)

- Chris Isidore (1)

- Wizard of Oz (1)

- Tin Man (1)

- Ted Waitt (1)

- Gateway (1)

- Jerry Brown (1)

- Keystone-Cop’y (1)

- Messrs. H and P (1)

- David Packard (1)

- Bill Hewlett (1)

- Mrs. Robinson (1)

- Morgan Housel (1)

- Motley Fool (1)

- instant grat (1)

- Washington D.C. (1)

- people-kind (1)

- values-added-in (1)

- 1040 (1)

- ink-blots (1)

- National Mall (1)

- White House (1)

- Bigfoot (1)

- Sasquatch (1)

- RAC world. (1)

- Roman Polanski (1)

- Macbeth (1)

- Out Damn Spot (1)

- financial models (1)

- SOL (1)

- Ps2B (1)

- 30-somethings (1)

- RAC (1)

- Ps-that-B (1)

- heal thyself (1)

- Tip O'Neill (1)

- for Pete's sake (1)

- Apple's cash (1)

- Lionel Richie (1)

- All Night Long (1)

- lock-in (1)

- mommy-van (1)

- Big Four Banks (1)

- credit unions (1)

- MBA-brain (1)

- Mom and Pop (1)

- Eric Clapton (1)

- 12/12/12 Concert (1)

- ESPP accounts (1)

- vessels (1)

- TTAs (1)

- OIGs (1)

- M. Scott Peck (1)

- Herman Cain (1)

- shucky ducky (1)

- Uncle Sam (1)

- tax-code-ese (1)

- carried interest (1)

- tax-rate-risk (1)

- Fab (1)

- When We Was Fab (1)

- Jeff Beck (1)

- amortizing (1)

- spread (1)

- 30-year mortgage (1)

- fully-amortizing (1)

- Paul Rogers (1)

- reactive death (1)

- proactive death (1)

- onco death (1)

- The Godfather (1)

- Sting (1)

- Roberta Flack (1)

- In My Life (1)

- Trent Raznor (1)

- Hurt (1)

- Nine Inch Nails (1)

- Rick Rubin (1)

- I Hung My Head (1)

- Sandy Hook (1)

- gallows (1)

- head-hanging (1)

- LLC (1)

- Ari Fleischer (1)

- R&D tax credit (1)

- Portland Oregon (1)

- Muni bonds (1)

- tax-goading (1)

- filibusters (1)

- ATRA (1)

- James Stewart (1)

- Frank Capra (1)

- Byrd Rule (1)

- EGTRRA (1)

- Tax Relief (1)

- 9/11/01 (1)

- TRUIRJCA (1)

- Gerard Depardieu (1)

- France (1)

- Russia (1)

- da mo' da betta' (1)

- Beatles (1)

- boundary event (1)

- Cleaver Family (1)

- Friedman Family (1)

- DNA (1)

- family stuff (1)

- eleventy (1)

- twelvety (1)

- J.R.R. Tolkien (1)

- The Who (1)

- long life (1)

- despising-lobby (1)

- RMDs (1)

- MRDs (1)

- FinancialWonks (1)

- F-Wonks (1)

- fwonks (1)

- TTDAs (1)

- RMDs vs. MRDs (1)

- MRDs vs. RMDs (1)

- the hard way (1)

- J.K. Rowling (1)

- leap days (1)

- scalars (1)

- SBUX (1)

- Starbucks (1)

- Lee Eisenberg (1)

- The Number (1)

- nest egg (1)

- Atrios (1)

- USA Today (1)

- Duncan Black (1)

- Eschaton (1)

- DB vs. DC (1)

- DC vs. DB (1)

- Oldsmobile (1)

- private accounts (1)

- DCs (1)

- DBs (1)

- chained CPI (1)

- Bernie Sanders (1)

- B-2-C dosey doe (1)

- lickety-split (1)

- portmanteau (1)

- Carole King (1)

- Eddie Haskell (1)

- June Cleaver (1)

- TBTF Banks (1)

- 2B2F (1)

- Citibank (1)

- Wells Fargo (1)

- BCCW Cartel (1)

- Fargo (1)

- Coen Brothers (1)

- Marge Gunderson (1)

- money supply (1)

- M1 (1)

- M2 (1)

- ya bet'ch'ya (1)

- you bet'ch'ya (1)

- price fixing (1)

- signaling (1)

- The Atlantic (1)

- Franz Kafka (1)

- rant (1)

- PITB expense (1)

- Kaiser (1)

- pooling risk (1)

- murder mysteries (1)

- high deductibles (1)

- Rip Van Winkling (1)

- asset gathers (1)

- Brylcreem (1)

- careful boss (1)

- precommitment (1)

- spending's reach (1)

- Suzy Khimm (1)

- Sequester (the) (1)

- Scott Galupo (1)

- Larry Kudlow (1)

- CNBC (1)

- Forbes magazine (1)

- yada yada yada (1)

- GHP (1)

- On and On (1)

- Stephen Bishop (1)

- CNBC.com (1)

- crowding out (1)

- The Economist (1)

- pension plans (1)

- take a powder (1)

- Roth conversions (1)

- shine it on (1)

- brain trust (1)

- roll-overs (1)

- mindfulness (1)

- bar dice (1)

- MindfulFinancial (1)

- making a living (1)

- brain trust'ees (1)

- do right by (1)

- Wiktionary (1)

- Bing Crosby (1)

- Romper Room (1)

- The Secret (1)

- Stanley Tucci (1)

- texting (1)

- Paul Bettany (1)

- Bob Marley (1)

- OIALTO (1)

- Oy ALto (1)

- Golden Rule (1)

- Charles Dickens (1)

- remodels (1)

- pets (1)

- dogs (1)

- veterinarian (1)

- BMW (1)

- Mercedes (1)

- CPA'y (1)

- spendthrift (1)

- sanguine (1)

- peruse (1)

- pets (cost of) (1)

- thrift shops (1)

- Steve Wonder (1)

- Elvis Presley (1)

- Mandy Patinkin (1)

- cats (1)

- cash-suck (1)

- kids (cost of) (1)

- San Rancisco (1)

- used car values (1)

- Kelley Blue Book (1)

- tax basis (1)

- rainy days (1)

- meta-don't (1)

- Seth MacFarlane (1)

- David Crosby (1)

- Fox News (1)

- Ben Affleck (1)

- marriage is work (1)

- Left Coast (1)

- Right Coast (1)

- gender politics (1)

- Ernest Hemingway (1)

- Tom Robbins (1)

- quiet rooms (1)

- Phoenix Books (1)

- Scarface (1)

- Compliance (1)

- Ayn Rand (1)

- Harold Robbins (1)

- Danielle Steel (1)

- Edward Tufte (1)

- PowerPoint (1)

- big cheese (the) (1)

- Cannes (1)

- WAG numbers (1)

- .xls (1)

- Form ADV-II (1)

- turnip blood (1)

- not equal to (1)

- greater than (1)

- less than (1)

- Hartford CT (1)

- Star Wars (1)

- mind-trick (1)

- mind-meld (1)

- economic rents (1)

- The Golden Rule (1)

- hippies (1)

- magic 7s (1)

- Jimmy McMillan (1)

- CCCs (1)

- hippie days (1)

- magic tricks (1)

- magicians (1)

- killing the 7s (1)

- Christpher Nolan (1)

- Batman Begins (1)

- The Dark Knight (1)

- Gran Torino (1)

- get off my lawn (1)

- no problem (1)

- you're welcome (1)

- thank YOU (1)

- customer service (1)

- CRM (1)

- Sacramento (1)

- Rancho Santa Fe (1)

- Pleistocene Era (1)

- VOIP (1)

- EFP (1)

- datadump (1)

- bifurc (1)

- garbage dumps (1)

- Ps that Be (1)

- batphone (1)

- Polycom (1)

- permutations (1)

- iterations (1)

- combinations (1)

- Lake Cook Road (1)

- Skokie Highway (1)

- Scott (1)

- Doug (1)

- Marty (1)

- snow fight (1)

- The Pretenders (1)

- Chrissie Hynde (1)

- My City was Gone (1)

- macro class (1)

- Andrew Rose (1)

- Greg Mankiw (1)

- MBA-types (1)

- DIY EPers (1)

- Dixie Chicks (1)

- Hoyt Axton (1)

- No No Song (the) (1)

- know-it-all (1)

- Cliff Clavin (1)

- Cheers (TV show) (1)

- zero lower bound (1)

- Ivan Pavlov (1)

- B.F. Skinner (1)

- signal and noise (1)

- signal (1)

- noise (1)

- noise and signal (1)

- Bat Chain Puller (1)

- French TV (1)

- Bobby McFerrin (1)

- acapella (1)

- Snagglepuss (1)

- Intuit (1)

- TurboTax (1)

- Mint.com (1)

- budgeting (1)

- budget (1)

- b-word (the) (1)

- Morningstar (1)

- Ibbotson (1)

- SCHZ (1)

- SWLBX (1)

- VBMFX (1)

- Lehman Brothers (1)

- Chuck (Schwab) (1)

- Talk to Chuck (1)

- Hollies (the) (1)

- ponies (1)

- piggy bank (1)

- Amazon (1)

- Andrew Sullivan (1)

- bottlenecks (1)

- Gavin Newsom (1)

- Andew Sullivan (1)

- Radiohead (1)

- In Rainbow (1)

- Henrietta Lacks (1)

- HeLa cells (1)

- Gollum (1)

- my precious (1)

- Boiler Room (1)

- paywall (1)

- Washington Post (1)

- Dataligix (1)

- Epsilon (1)

- Axciom (1)

- Mark Wahlberg (1)

- Marky Mark (1)

- Mark Zuckerberg (1)

- Trojan Horse (1)

- DRE (1)

- life agent (1)

- contractors (1)

- realtors (1)

- Mr. McGuire (1)

- The Graduate (1)

- plastics (1)

- Eddie Arnold (1)

- SEO (1)

- Wikipedia (1)

- dogwalkers (1)

- UFO guy (1)

- SEO'y (1)

- TBToIBI (1)

- TBFoIBIA (1)

- Hindenberg (1)

- Gordon Gekko (1)

- probate (1)

- living trusts (1)

- revocable trusts (1)

- Napoleonic Code (1)

- Edwin Starr (1)

- lipsynching (1)

- War (song) (1)

- Louisiana (1)

- probate court (1)

- probate process (1)

- gift tax (1)

- CUSIP (1)

- NWUM fees (1)

- Bud Fox (1)

- magic dollars (1)

- Charlie Sheen (1)

- hourly fees (1)

- flat fees (1)

- passive voice (1)

- FRED charts (1)

- bear markets (1)

- Vladmir Putin (1)

- Richard Thompson (1)

- Linda Thompson (1)

- Information Week (1)

- Windows Vista (1)

- Windows 8 (1)

- WIndows XP (1)

- Marc Andreessen (1)

- Ameritrade (1)

- Datek. (1)

- DIY investing (1)

- Spiders (1)

- Qs (1)

- Wall Strret (1)

- day trading (1)

- hospice care (1)

- Guy Murchie (1)

- Joel R.Primack (1)

- sound of cicadas (1)

- cicadas (1)

- Jake Scully (1)

- Avatar (movie) (1)

- tall people (1)

- zeros (1)

- gladiating (1)

- Keystone Cops (1)

- FUBAR (1)

- SNAFU (1)

- medical journey (1)

- C corp (1)

- S corp (1)

- self-employment (1)

- say no more (1)

- U.S. Treasury (1)

- debt default (1)

- Stan Collender (1)

- Bruce Bartlett (1)

- lumpy revs (1)

- line of credit (1)

- Californa (1)

- Balance Sheet (1)

- Income Statement (1)

- Gene Simmons (1)

- lumpy revenues (1)

- predict (1)

- pre-dict (1)

- post-dict (1)

- Karl Rove (1)

- Ess Eff (1)

- hockey (1)

- mortgage rates (1)

- triangular lots (1)

- scale tales (1)

- Twitter IPO (1)

- Mexican Museum (1)

- Four Seasons (1)

- Socket Site (1)

- what-if'ing (1)

- maths (1)

- arithmetic (1)

- round numbers (1)

- linearity (1)

- Oliver Twist (1)

- No soup for you! (1)

- too much money (1)

- Jason Hull (1)

- Dr. McCoy (1)

- FAFNF (1)

- AUM (1)

- Motortrend (1)

- > (1)

- < (1)

- Ferrari (1)

- Isaac Newton (1)

- SF Curbed (1)

- TWTR (1)

- Investopedia (1)

- dutch auctions (1)

- Ferrari FF (1)

- V8 engines (1)

- V12 engines (1)

- IPO scandal (1)

- Tracey (1)

- Stockton (1)

- Vallejo (1)

- Socketsite (1)

- Friendster (1)

- MySpace (1)

- public offering (1)

- bubbles (1)

- 3/20/2000 (1)

- 8/15/2008 (1)

- BIT (1)

- fax machines (1)

- Mosaic browser (1)

- Marc Andreeesen (1)

- Barrows Hall (1)

- UC Berkeley (1)

- Lynx (1)

- 11/11/1993 (1)

- NCSA (1)

- Chambana (1)

- free (1)

- healthcare.gov (1)

- HITECH Act (1)

- ARRA (1)

- Stimulus (the) (1)

- Jennifer Garner (1)

- pre-Mosaic (1)

- Yardbirds (the) (1)

- Beatles (the) (1)

- zeitgeist (1)

- census (1)

- Houston (1)

- Virginia (1)

- zero-sum game (1)

- voting systems (1)

- Rand Paul (1)

- transfat (1)

- systems (1)

- variance (1)

- VA AG (1)

- statistics (1)

- bell curve (1)

- Batkid (1)

- Miles Scott (1)

- Cancer.org (1)

- IBC (1)

- TruthOut (1)

- Medi-Cal (1)

- Zuccotti Park (1)

- Occupy (1)

- Occupy movement (1)

- Batman kapow (1)

- 401k match (1)

- vesting (1)

- FPL (1)

- mulitplier (1)

- stimulus (1)

- Nick Gillespie (1)

- Reason.com (1)

- free money (1)

- Effie Trinket (1)

- steps per mile (1)

- petri dish (1)

- pertussis (1)

- whooping cough (1)

- match patch (1)

- Whole Life (1)

- Univeral Life (1)

- language fail (1)

- Taylor Swift (1)

- Alabama Shakes (1)

- Letterman (1)

- Hold On (song) (1)

- 4% Rule of Thumb (1)

- 6% Rule of Thumb (1)

- Rolling Stones (1)

- Joe McConnell (1)

- Sunol Grade (1)

- lemmings (1)

- oil wildcatting (1)

- Fugs (the) (1)

- George Clooney (1)

- monkey brain (1)

- Stevie Winder (1)

- Hogan's Heroes (1)

- drought of 2013 (1)

- Mont (1)

- collectibles (1)

- 49ers (1)

- smartned-up (1)

- Panthers (1)

- KISaSSYPGE (1)

- Punditracker (1)

- Big Four (the) (1)

- Titanic (move) (1)

- Jim Cramer (1)

- snake oil (1)

- Samsung (1)

- Tesla (1)

- financial media (1)

- iPhone 5C (1)

- iPhone 5s (1)

- football (1)

- Seattle Seahawks (1)

- Richard Sherman (1)

- Superbowl (1)

- violence (1)

- Peggy Lee (1)

- Geritol (1)

- job-lock (1)

- google bus (1)

- technology (1)

- indoor plumbing (1)

- Internet (1)

- fish gotta swim (1)

- ejection seat (1)

- Aston Martin (1)

- Sean Connery (1)

- Aston Martin DB5 (1)

- job unlock (1)

- a cappella (1)

- human capital (1)

- stress (1)

- bee's knees (1)

- Clint Black (1)

- Anya Schiffrin (1)

- Craig Kilborn (1)

- Cancer Institute (1)

- cancer staging (1)

- Paris (1)

- Andre Schiffrin (1)

- Manhattan (1)

- value-detract (1)

- Homer Simpson (1)

- Medicare Part C (1)

- Medicare Part A (1)

- Medicare Part B (1)

- jungle lasso (1)

- Sherrod Brown (1)

- Medicare for All (1)

- death tax (1)

- SOI (1)

- FPA (1)

- FPA SF (1)

- estate planners (1)

- appraisers (1)

- Karen Valentine (1)

- Austin Powers (1)

- oh behave! (1)

- Tucson Arizona (1)

- x axis (1)

- COD (1)

- Rush Limbaugh (1)

- EIB Network (1)

- Peter Fisher (1)

- AM960 (1)

- Felix Salmon (1)

- Slate (1)

- Michael Lewis (1)

- Flash Boys (1)

- GNH (1)

- Rush Revere (1)

- rushlimbaugh.com (1)

- NIMH (1)

- ADHD (1)

- Sandra Fluke (1)

- TheBigUs.com (1)

- Big Us (The) (1)

- CYA (1)

- legalese (1)

- boilerplate (1)

- hyper-fast-talk (1)

- FSIC (the) (1)

- asbestos (1)

- cancer (1)

- Pablo Picasso (1)

- HIPAA releases (1)

- CSW (1)

- holographic will (1)

- wills (1)

- trusts (1)

- living wills (1)

- Nolo Press (1)

- Maine (1)

- Michigan (1)

- New Mexico (1)

- Wisconsin (1)

- executors (1)

- guardians (1)

- bond (surety) (1)

- surety bond (1)

- Bali (1)

- deadlines (1)

- pre-commitment (1)

- Bullmastiffs (1)

- proximate cause (1)

- Basset Hounds (1)

- Saint Bernards (1)

- spam-evildoers (1)

- spambots (1)

- Alan Goldfarb (1)

- fee-based (1)

- fee-only (1)

- FP'er (1)

- business models (1)

- plumbers (1)

- shoes (1)

- shoe salespeople (1)

- insurance (1)

- vigs (1)

- vigging (1)

- ownership (1)

- cake-eating (1)

- vigorish (1)

- King of Assets (1)

- Queen of Assets (1)

- -Onlies (1)

- -Baseds (1)

- ALEC (1)

- LUST (1)

- Magnum P.I. (1)

- P.I. lawyers (1)

- whiplash (1)

- malingerers (1)

- totaled car (1)

- Hartford (1)

- Kelly Blue Book (1)

- KBB (1)

- Edmunds (1)

- NADA (1)

- cars (1)

- automobiles (1)

- Scorpion (1)

- scrap value (1)

- Michael Jackson (1)

- Diana Ross (1)

- Quincy Jones (1)

- Rover 2000TC (1)

- P.I. law (1)

- trade rag (1)

- trade magazine (1)

- trade mag (1)

- Rupert-Murdoch (1)

- Financial Times (1)

- Antwerp flashmob (1)

- Julie Andrews (1)

- Do Re Mi (song) (1)

- Sound of Music (1)

- Merriam Webster (1)

- bollix (1)

- hotchpot (1)

- punctilio (1)

- fightin' words (1)

- MS-DOS (1)

- Murdochian (1)

- IBD (1)

- Sire Pukes-A-Lot (1)

- TLAs (1)

- FP50IBD (1)

- WFs (1)

- Full Monty (1)

- churning (1)

- reverse churning (1)

- stockbrokers (1)

- stockbrokerages (1)

- Point A (1)

- Point B (1)

- DOS (1)

- wealthy folks (1)

- generalists (1)

- Google Machine (1)

- RIA (1)

- RIA-land (1)

- flashmob (1)

- Mark Knopfler (1)

- Wembley (1)

- Louis Armstong (1)

- Enron (1)

- Enron 401k plan (1)

- Janus funds (1)

- SMB market (1)

- handsome ransome (1)

- U.S. Congress (1)

- Carl Levin (1)

- Daniel Sparks (1)

- Timberwolf I (1)

- shitty deal (1)

- Goldman Sachs (1)

- rotten deal (1)

- CDOs (1)

- derivatives (1)

- Bogleheads (1)

- Solo 401k Plan (1)

- i401k plan (1)

- NGO (1)

- NGO'ed (1)

- Boomtown Rats (1)

- Bob Geldof (1)

- LiveAid 1985 (1)

- Aragorn (1)

- The Black Gate (1)

- bliss ninny (1)

- mortality (1)

- Romeo and Juliet (1)

- Comcast (1)

- AT&T (1)

- Verizon (1)

- SBC (1)

- PacBell (1)

- email addresses (1)

- nemesis (1)

- IT department (1)

- Yahoo! (1)

- gmail (1)

- Yahoo! Mail (1)

- Shades of Grey (1)

- true-dat (1)

- Internet domains (1)

- domination (1)

- email spoofing (1)

- spoofing (1)

- spam (1)

- database design (1)

- air-quotes (1)

- free advice (1)

- grace-provider (1)

- very-scary (1)

- luck of the draw (1)

- Brochures (1)

- SLN (1)

- Monterey CA (1)

- genie wishes (1)

- grin (1)

- MSK (1)

- friction (1)

- paperwork (1)

- New York (1)

- NYC (1)

- complexity (1)

- larding-up (1)

- private equity (1)

- speech therapy (1)

- physical therapy (1)

- gym class (1)

- parents (1)

- Will Robinson (1)

- Lost in Space (1)

- gym (1)

- PE class (1)

- Lisa Loeb (1)

- Stay (song) (1)

- beeps (1)

- bips (1)

- the Fed (1)

- AMT (1)

- Gretchen Wilson (1)

- country music (1)

- ton of tons (1)

- sunsetting (1)

- visibility (1)

- income averaging (1)

- tax shelters (1)

- lumpy income (1)

- tax fairness (1)

- tax complexity (1)

- tears (1)

- Bob Dylan (1)

- tears upon death (1)

- caregivers (1)

- mortal plane (1)

- midnight (1)

- 12:01 a.m. (1)

- dying moment (1)

- moment of dying (1)

- death tears (1)

- Goldilocks (1)

- Google Sheets (1)

- pricing theories (1)

- Google Suite (1)

- GOOG vs MSFT (1)

- magic numbers (1)

- MSFT vs GOOG (1)

- nit (1)

- gnat (1)

- Black Swan (1)

- Lehman Bros. (1)

- This Old Dog (1)

- NDIC (1)

- Bay Area (1)

- Italy (1)

- oil prices (1)

- piker (1)

- chalk line (1)

Friedman’s Law of the First Thing: Using the Investment Adviser Public Disclosure Site to Smarten Up About Financial Planners and Money Managers

Monday, June 3, 2013 at 8pmBy John Friedman

Oodles of ’em. Oodles and oodles of ’em, even.

There are oodles and oodles — and then some — of articles out there about how to find, interview and ultimately hire yourself a good financial planner or money manager.

I can’t recall a single one of them, though, talking about the IAPD. Which is too bad because, up from its humble and essentially unusable beginnings, the IAPD is now an excellent and quick way to smarten up about the financial planning and money managing folks you are thinking of bringing into your life (or those you already have in your life . . . ).

So what’s that you say? You’ve never even heard of the IAPD?

You are not alone!

But you really should know about it because, when it comes to being smart about financial planners and money managers and the like, to know how to use the IAPD — the Investment Adviser Public Disclosure website — is to know the first thing about how to be smart about those particular kinds of financial services professionals, and you really owe it to yourself to know, at least, the first thing about each aspect of your financial life, so if you have that kind of financial service professional in your life, or if you are considering bringing one in, then you really ought to take a look-see at that FSP in the IAPD and see what there is to see.

Or at least so sayeth Friedman’s Law of the First Thing, as applied to this very important part of building up and maintaining your financial brain trust.

* * *

Most regulated industries have websites which allow you to look up the people who are regulated within the industry. For instance, keeping it close to (my) home, there are online lookup sites that spit out licensing info about California lawyers, California realtors, California CPAs, California insurance agents, California doctors, and California contractors, to just name a few. And here in the ever-so-loverly SFCA, we are just now embarking on regulating dogwalkers, so no doubt you can expect to soon see an online licensee database lookup site for Ess Eff Sea Ay dogwalkers, too.

Most apropos here, though, is the online licensee database lookup site for financial planners and money managers, called the Investment Adviser Public Disclosure site, or IAPD for short.

Aside: financial planners and money managers are usually lumped together, regulatorily speaking, within the same Investment Adviser regulatory regimen, and I will also lump them together here. And just to keep things accurate but further confusing, stockbrokers are not regulated as Investment Advisers — except when they kinda are. It’s all very confusing — intentionally so some would surmise.

Like most of the licensee-lookup sites linked-to above, when the IAPD first launched it was difficult to use and difficult to link-to. Happily, these days it’s easy to use and it’s possible to link to actual licensee records, which the IAPD will then happily serve up to all comers via a single click. Very nice (update: though, as that now not-great link demonstrates, those links don’t work over the long-run)!

Sorry to say, though, as best I can tell the IAPD isn’t used very much. My evidence for this statement is only indirect but it is, I think, quite solid. The first bit of evidence is that, outside of folks in the industry, I’ve never run into anyone who has ever heard of the IAPD: I’ve asked, and no one I’ve ever asked knows it exists, either by name or description. The second bit of evidence is that, when I just now did a search for “IAPD” on Google, the first entry on the results page was for the much more mainstream (!?!) International Association of Plastics Distribution. So it appears the international plastics cartel folks are stomping the IAPD in SEO-land big-time!

And let’s get narrow on this, too, shall we? They say Google really knows who each of us is, right? It/they track what we do, it/they track what we read, it/they track what we search, etc., and then, using that information about us, it/they tailor everything it/they serve up to us. Yet, here I was, doing that search on my everyday computer, which has Google’s paw prints all over it, and plastics came up first. Hey GOOG-machine-in-the-sky, you really think I want to know more about plastics than about investment advisers? Well, why then, you don’t know me. And also: IAPD folks, might you work towards upping your mindshare?

* * *

And so what comes next on our search to find the elusive IAPD?

I’m sorry to say that the news on the IAPD web-presence front gets yet worse, because, while the second entry on the Google-search results page is in fact for the Investment Adviser Public Disclosure site, that entry is not a link to the licensee-lookup page; it’s a link to an “answers” page about the IAPD rather than to the licensee-lookup page itself. Hey IAPD folks: your page answering questions about the IAPD is getting more hits than the IAPD itself. What’s wrong with that picture?

But I protest too much. Dothly, even. By my recollection, it used to be that that FAQ page blurb didn’t even have a link to the actual IAPD licensee-lookup page; now it does have such a link, but clicking on that link takes you to a page which has some text which in turn tells you where to click on the left nav-bar on that page to get to the actual page with the IAPD tool. Not great web design, folks!

So three clicks past the second entry on a Google search result page, and that’ll get you there — that’ll get you to the IAPD.

* * *

Once you’re there, things get better — information flows and your smartening-up begins.

To begin, you’ll be warmly greeted by this page:

Once you get to this page, you’re about two clicks away from getting smartened up (yup: that’s five clicks to get you to the good stuff — given the pace of past IAPD developments, perhaps we can expect two years from now the IAPD designers and coders will have this down to two clicks).

You’ll usually want to click on the “Firm” radio button at the bottom of the tool because that’s where the good stuff is — later on you can always look up the individual with whom you’re having direct dealings.

Once you select that button, the blank box at the bottom of the screen below the radio buttons will sprout into this:

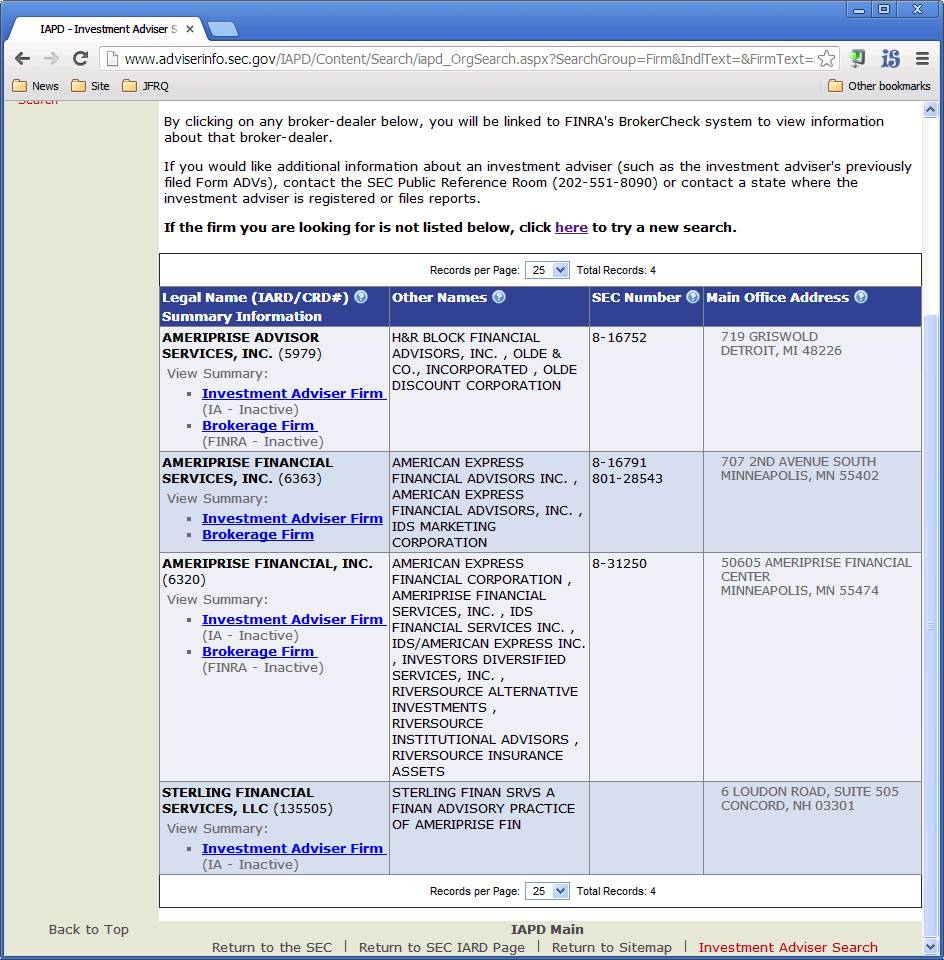

From there just type in the name of the planning or money management firm you want to research — which for me this morning was Ameriprise — and hit “return,” at which point you’ll see something like this:

If you are typing in the name of a small firm — particularly one with a unique name — you’ll usually just get one entry. Here, looking up “Ameriprise” we get a bunch, but if you look carefully at the picture above, you’ll see that every entry shown is for an “inactive” Ameriprise-something-or-other except for the entries in the second chunk — the entries in the first slightly-darker-blue stripe. That’s where the meat of the current Ameriprise regulatory matter is.

If you then click on the “Investment Adviser Firm” link in that slightly-darker-blue stripe, you’ll see one last page that you have to click on before you get to the good stuff. This page will tell you either that the firm you are looking at is registered with the SEC or with a state regulator. The difference can be important, but, for our present purposes, you don’t much care about what’s on this page (or, for that matter, what the SEC is or whether you should care if you are transiting through a state or an SEC interstitial page); it’s stuff that is important from some perspectives, but from your perspective in this particular context it is all just another log-jammin’, slow-ice-flowin’g, legalese’y piece of info interjected into your info stream, running the very real risk of losing your impatient eyeballs to all the other eye-candy click-bait readily available elsewhere on the Net via a single, effortless, swift click. Poof, you’re gone.

But don’t let that be you. Please stay! Please stick to it! You’re almost there. Just click through those interstitials and continue on, because now, a mere seven clicks in, you’re at the front door of the information you seek.

* * *

Here’s what it looks like:

From there you can click on each of the Items in Part 1A, as shown in the left nav-bar, and reach each page individually. If you have a decent Internet connection and are happy with very long-scroll pages, then you might well find that the better practice for you will be to click on the “View All” link in the left nav-bar — just below where it says “Sections of Form ADV” and to the left of the word “business” just above the “C.”

Click on that puppy and a pop-up window will open containing all the pages of the main document you’ve been seeking. Now you’ve got something you can navigate around in — something you can print to a pdf or save as a Word file, etc. Because by now you’ve probably gotten the idea that the IAPD site is, by today’s standards, a click-efficiency nightmare, right? So think about grabbing a hold of that whole document and get ye out of the IAPD web space, OK?

* * *

Now that you’ve lassoed this big, admittedly-gnarly document, it’s a really good idea to look through the whole thing.

But we’re all busy, right? So, at minimum you want to look at Item 5, where you’ll find most of the juicy, useful information, including, among other things:

- The number of employees the firm has (an astonishing 12,528 workers for Ameriprise, not including clerical workers, with 10,834 of those 12,528 workers, I would presume, happy, able and licensed to sell you some insurance too)

- The number of clients the firm has (an also astonishing 1,319,600 clients) and the types of clients it has (something up to half of Ameriprise’s clients are NFs, i.e., Normal Folks, as opposed to HNWs, i.e., High Net Worth individuals, who in turn account for something up to a quarter of its client base)

- The dollars the firm is managing ($124.65 billion for Ameriprise) and the number of customer accounts (1.08 million Ameriprise customer accounts).

And then, just like when you look up lawyers and doctors and such, you want to find out if the firm you’re looking up has ever been in trouble and/or ever gotten in hot water for doing the wrong thing with respect to the people it serves. For this you go to Item 11. You want to see a lot of “no” answers. For Ameriprise, you’ll see a lot of “yes” answers.

And if you really want to know what the firm is up to — what its business model is like, what it values, how it speaks about itself, etc., then be sure to also see Part 2, which is where you’ll find links to the firm’s Brochures. Brochures fulfill a relatively new requirement in this regulatory context, having been a part of the regulatory filing process for about three years now. The Brochure requirements obligate each firm to write out a narrative in which the firm has to answer broad questions and speak its peace about broad topics, so that, through the firm’s narrative, you can really get a good taste for the look and feel and sound and touch of the firm, and for the way it makes its way through the world and makes its bed and butters its bread within the Financial Services Industrial Complex — within the FSIC.

Is the firm’s Brochure all formal and legalese’y and boilerplate’y and CYA’y, or is it something else? Friendly and personable and helpful, maybe?

* * *

The firm you’re looking up is apt to look quite different in the IAPD from what Ameriprise looks like in there because Ameriprise is a pretty unique outfit. I use it as an example here because it is so very full-bore: everything about it is magnified.

For instance, if you’re looking at a small firm that’s been in any kind of hot water, that’s pretty troubling because, while big firms have problems like this due to their sheer size (if you had 12,000 employees, do you think you could keep all of them on the straight and narrow?), small firms are usually able to run a tight ship and clean house quickly when one of their own is in even lukewarm water.

Likewise, if the firm you’re looking up has a handful of employees, as many do, then it might have something less than a hundred-handfuls of clients and some tens of millions or perhaps some handfuls of hundreds of millions of dollars under management. And if it has a billion or more dollars under management and is not a household name? Then, to my way of thinking, that firm is pretty darn large and, in terms of dollars-managed at least, pretty highfalutin to boot; it’s apt to have gross revenues of $10 million or more (because most firms charge annual assets under management fees in the neighborhood of 1% of assets under management, i.e. and a/k/a 1% AUM Fees).

And, oh yea: are you wondering how assets under management has anything to do with financial planning and financial advice? I always wonder about that too, and write about it from time to time, most recently when I posed the question, When You Get Financial Advice for Free, are You the Product? and in which I declared:

The business you’re in is the one for which you get paid

by which, as seen from the client’s perspective, I meant: if you’re paying some firm an Assets Under Management fee, then the service you’re buying from that firm is an assets management service, not a financial advisory service.

* * *

So please remember: reading up about your financial planning firm or money management firm on the IAPD is the first thing — it’s the first thing you should do to learn about those folks. You can also think of this in negative terms: how big a schmo would you feel like if you hired a money management firm and learned, after the fact, that if you had simply looked that firm up on the IAPD when you were first considering bringing that firm into your financial life, then you would’ve learned that the firm had gotten into all sorts of hot water over the years for doing things to its clients which it — guess what? — ultimately did to you too? So you were constructively forewarned, but you totally failed to read the forewarning: big time schmo-feeling, that.

If you have a firm whose IAPD information you’d like to discuss with me, please contact me and we’ll make it so. I’m always happy to help people smarten up about the financial planner or money manager they are thinking about bringing into their life — or have already brought into their life, because, let’s face it, sometimes the first thing comes second and the second thing comes first.